Contact Us

We'd love to get to know you and your business better. Let us know how we can help.

Accountable Bookkeeping, LLC

309 East Main Street, New Holland, Pennsylvania 17557, United States

O: 717.351.4105

F: 717.351.5244

Contact Us

Signup to receive our eNewsletter. By

Newsletter Sign-Up

Recent News

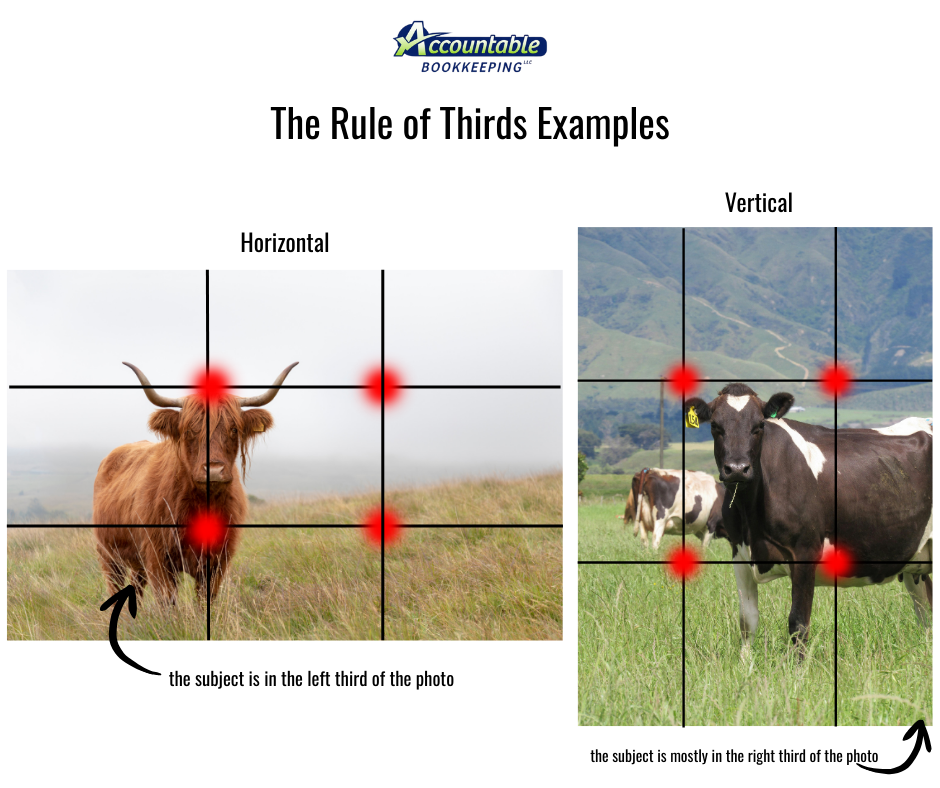

Are you cropping a photo to use in your newsletter, website, or advertisement? Here is an easy rule to keep in mind. The Rule of Thirds is an off-center way to crop (or take) a photo along a 3x3 grid that divides your photo into 9 equal parts. This helps to keep the subject of your photo clear to the viewer. When you crop your photo, identify the most important element or subject of your photo (example: a cow in a field) , then imagine a 3×3 grid (the cropping tool will often have the grid in place), and crop so that your subject (the cow) is at one or two of the 4 intersection points along that grid. This works horizontally and vertically.

To be eligible to be exempt from Social Security and Medicare taxes you must meet the following requirements: You are a member of the Amish Church Complete a form 4029, have it signed by your bishop. Your employer is also Social Security and Medicare Exempt You will continue to have Social Security and Medicare withheld from your paycheck until you receive the approved 4029 form back from the federal government. Your exemption status will go into effect on the first day of the first quarter after the 4029 application was filed. For example, if you filed your application on 11/01/25 your exemption status would go into effect on 1/01/2026. Therefore, you will be reimbursed for any Social Security and Medicare that was withheld after the effective date. Your exemption status is good for life so you will want to keep your approved form in a safe place so you can provide it to any future employers.

When to Use Bills: Use Bills in QuickBooks Online when you receive an invoice from a vendor but haven’t paid yet. For example: You receive a $2,000 invoice from your graphic designer, due in 15 days. In QBO, you’ll record it as a Bill under + New → Bill. Later, when you actually pay it, you’ll go to + New → Pay Bills. This approach keeps your Accounts Payable (A/P) accurate and ensures you can track unpaid vendor balances and upcoming payments. When to Use Expenses: Use Expenses when you’ve already paid the vendor — immediately or on the same day. For example: You pay $100 at Office Depot for supplies using your business debit card. In this case, you’ll record an Expense under + New → Expense. QuickBooks will immediately reduce your bank balance and record the purchase. Think of it this way: Did I already pay for it? → Record an Expense Do I still owe money? → Record a Bill And when you pay the Bill later, don’t enter a new Expense — use Pay Bills in QuickBooks Online. If you still have questions, contact us!

As year-end approaches, start looking at your QuickBooks file for 1099 recipients. QuickBooks does have a 1099 summary report, however the eligible vendors must be set up correctly in order to show on that report. In the vendor set up, click on Tax settings. Be sure to check the box that says, “vendor eligible for 1099” and enter the tax identification number. It is important to receive a W9 form from each of your 1099 vendors to make sure of the entity type, the correct address and correct EIN or SS number are in your file.

Did you know, you can use Mailchimp, an email marketing platform, for free? The free plan allows you to have up to 500 contacts and includes 1,000 email sends per month. This plan also gives you limited access to your email analytics where you can see who opened the email, who unsubscribed, who clicked, and more. Need help setting up an account and getting started with your email marketing? Email our Marketing & Office Coordinator!

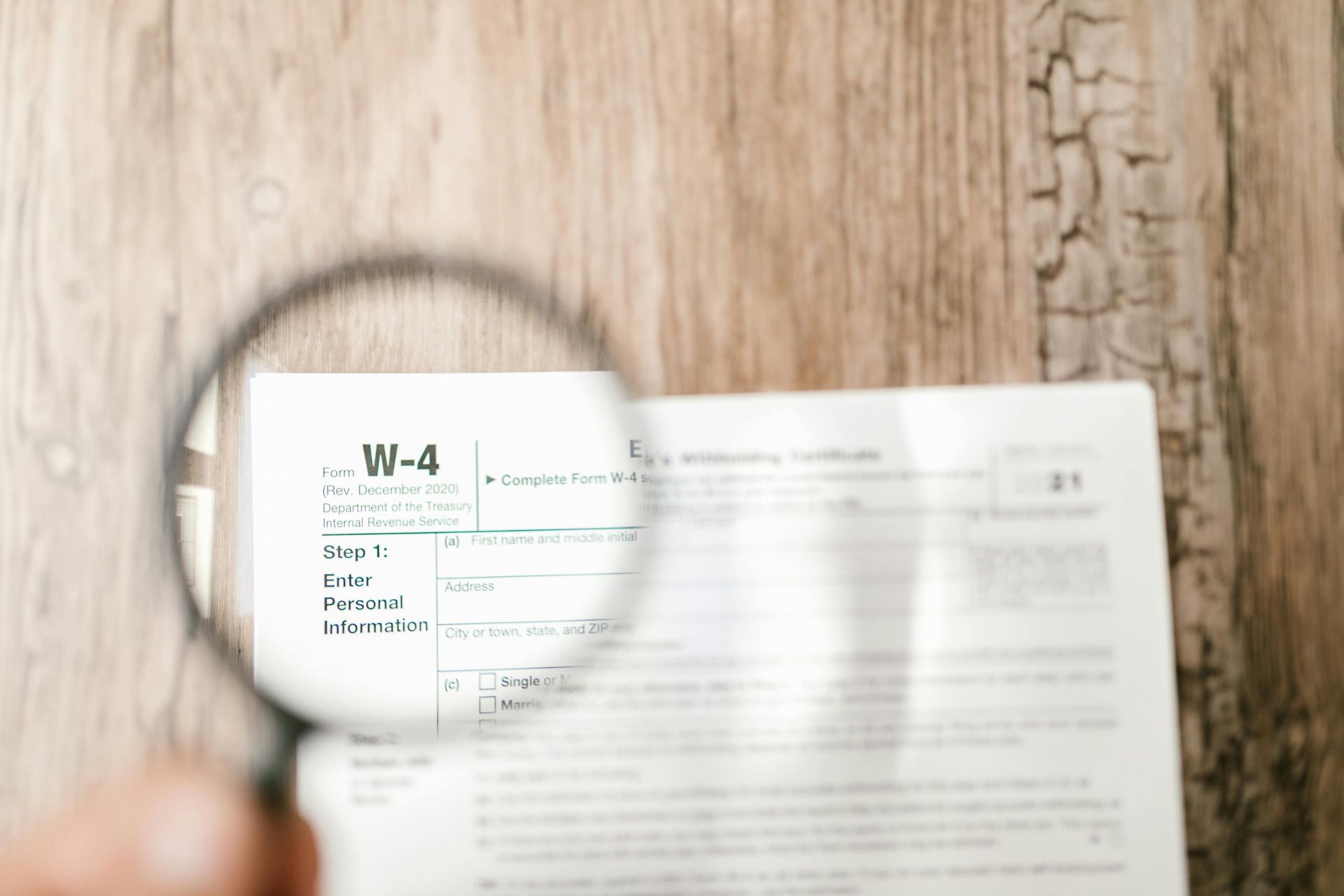

You should update our W-4 whenever you experience a major life event or financial change that will impact on your taxes. This ensures you have the correct amount of federal income tax withheld from your paycheck through the year, helping you avoid owing taxes or incurring penalties at the end of the year. Major life events that could impact your taxes: Marital status change: Getting married or getting divorced can place you in a different tax bracket. Birth or adoption of a child: Adding a new child can qualify you for tax credits, such as the Child Tax Credit, which can reduce your overall tax burden. Home purchase: Buying a home can make you eligible for tax benefits, such as a deduction for mortgage interest. Retirement: Entering retirement is a significant lifestyle change that affects your income and tax withholding. It is good practice to review and update your W-4 at least once a year , especially early in the year. The IRS offers an online tool to help you calculate the correct amount of tax to withhold based on your specific situation. You can also confer with a tax accountant if you have questions on how to fill out your W-4 for your specific tax situation. You can submit a new W-4 to your employer at any time throughout the year.

When you’re managing your business in QuickBooks Online®, it’s easy to get confused between Bills and Expenses . Both seem to record money going out, but they serve very different purposes — and using the wrong one can mess up your books, cash flow, and reporting. The key difference comes down to timing and payment method. Refer to the cheat sheet below to help you next time!

Instead of analyzing your entire business, you may want to look at smaller divisions, such as locations, departments or teams. Class tracking will first need to be turned on in your Preferences (under Edit in the menu bar) Set up and name the classes you want to track When entering transactions, a class will need to be specified Profit & Loss by class report will show you the profitability of each class Contact us for more information or assistance in getting classes set up!

1. Organizing your filing system as you go. If you have an organized filing system (which you should), continue to keep the correct documents in the correct folders as you go. This helps you find what you need quicker, saves you from having to do it all at once and risking forgetting what everything is and where it goes. 2. Keeping your calendar up to date & accurate. Keep your events up to date and accurate, especially if your whereabouts affect other people on your team. Even for yourself, an organized and clear calendar helps bring your focus to each day. 3. Keeping an organized to-do list that makes sense to you. Whether it’s physical, on your computer or phone, as long as you know what your list means and can easily gage where you’re at on your tasks, that’s the important thing.

It is extremely important to make sure your tax deposits get paid on time, if not there will be interest and penalties assessed to you. The following are the due dates for your tax federal tax deposits: Weekly filer : if your payday is Saturday - Tuesday, your deposit is due on Friday of the same week, if your pay date is Wednesday- Friday your deposit is due the following Wednesday. Monthly filer : your tax deposit is due on the 15th of the following month Quarterly filer : if your tax liability is less than $2,500 for the quarter you can pay the taxes with the quarterly tax return which is due the last day of the following month. (i.e.: 1st quarter is due April 30th, 2nd quarter is due July 31, etc.) Making your tax deposits on time are part of our payroll services. We will gladly help you make your tax deposits if you do your own payroll, we just need a payroll summary for the correct period that is due . This is when it is very important to get us this information as soon as you process your payroll, so that we have time to make the deposits on time.